The Medicaid “managed care” story told in Part One, where billions of taxpayer dollars are spent paying private corporations that regularly cut corners and fail to provide promised care, is mirrored by the tale of Medicare Advantage plans. Twenty million Americans on Medicare have chosen the private insurance option of Advantage plans, a number that represents a full one-third of Medicare enrollees. Many experts predict that, within a few years, half of all Americans on Medicare will be enrolled in an Advantage plan.

That enrollment is fueled by the aggressively advertised surface attractions of Advantage plans. The private plans set a limit on out-of-pocket medical expenses which traditional Medicare does not. And some Advantage plans offer added benefits like dental, vision, and drug coverage.

These are options that work well for many seniors. But there is a catch: the corporations more than make up their costs of offering these benefits by cutting their expenses elsewhere. As with Medicaid managed care plans, they restrict enrollees to a limited network of providers, which means that going out-of-network for care can trigger a huge cost to patients. That outcome can be difficult to avoid, as a Center for Medicare and Medicaid Services analysis showed that nearly half of all Advantage corporations’ listings of network-included physicians contained errors. The Department of Justice in 2017 fined two Advantage plans $32 million for misrepresenting the scope of their networks.

For-profit Advantage corporations choose their network options with the goal of saving expenses and maximizing profit. And that can lead to compromised patient care. A Brown University study showed that Medicare Advantage enrollees are more likely to enter a lower-quality nursing home than someone enrolled in traditional Medicare. Those findings were included in a Kiplinger’s Retirement Report analysis showing that Advantage plans can work well for seniors—as long as they don’t need too much care. “But if they become ill or injured and really need a significant length of care, they are not as well-served,” Judith Stein, executive director of the Center for Medicare Advocacy, told Kiplinger’s.

Denying Valid Insurance Claims, Increasing Profits

That conclusion is consistent with a recent, disturbing report by the inspector general of the U.S. Department of Health and Human Services. The inspector general found “widespread and persistent problems” with improper denials of care and payment by Advantage programs. The report showed that three of every four appeals of Advantage program denials of care and payment led to reversals at the very first stage of review, a remarkably high error rate.

Less remarkable was the inspector general’s conclusion about the root cause of so many wrongful denials of care and payment. As with Medicaid managed care programs, Medicare Advantage corporations are paid a set fee per patient, thus creating the motive to deny expensive claims. “A central concern about the (Advantage program) is the potential incentive for insurers to inappropriately deny access to services and payment in an attempt to increase their profits,” the inspector general concluded. Those attempts to increase profits are remarkably successful: from 2016 to 2018, corporations with Advantage plans collected gross profits of $1,608 per covered person per year, twice the industry margins for insurance in private individual and group plans.

The savings from wrongfully denied care may be fueling profits, but they are not reducing costs to the taxpayers that fund the programs. In fact, Medicare Advantage programs cost the government 4% more per person than traditional Medicare. Federal audits show the Advantage plans overbilled taxpayers as much as $10 billion per year.

Why Not a Public Option?

Most of us who have wrangled with our own health insurance companies are well aware of the problems inherent in a system that incentivizes the denial of care. Health insurance corporations reliably score near the bottom of consumer satisfaction surveys. How can that dismal corporate image be reconciled with the claims of some Democrats like Speaker Pelosi that “a lot of people love having their employer-based insurance”?

It turns out that Pelosi et al. are misreading the views of the American public. When polling questions drill down a bit, they reveal that people want to retain access to their preferred healthcare providers, not necessarily their insurance company. And keeping access to providers is actually far more likely in a public Medicare for All system, which features free choice of providers, than in a network-constrained system of employer-provided for-profit health insurance. In our current private insurance model, job turnover and employer-initiated plan changes mean that one of every four Americans switch their health insurance plans each year, and risk being barred from their preferred doctor or hospital as a result. Unsurprisingly, Americans enrolled in Medicare or Medicaid rate their insurance more favorably than those on employer-sponsored plans.

So why not embrace a public option plan? Surely, the clear benefits of the public health plan—with no deductibles, no incentive to deny claims, and broader access to providers—can compete favorably with private insurance. As Biden says, “ "Whether you're covered through your employer or on your own or not, you all should have a choice to be able to buy into a public option plan for Medicare . . .If the insurance company isn't doing the right thing by you, you should have another choice."

That choice would be a no-brainer--if the competition was a fair one. But it won’t be. As is already the case with Medicare vs. Medicare Advantage, for-profit corporations will push the sicker and more expensive enrollees to the public program—thus socializing the risk of insurance while privatizing the profits.

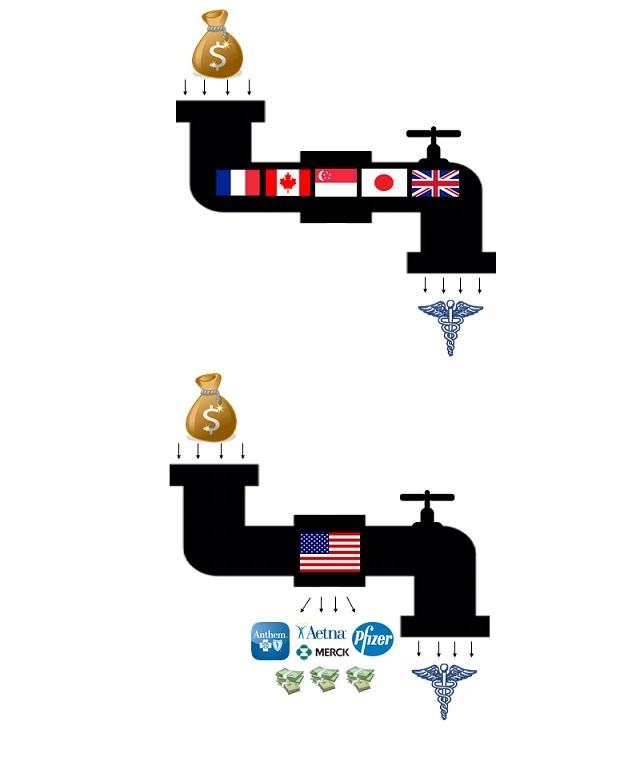

Plus, those corporations will inevitably deploy their legions of lobbyists and millions in campaign dollars to push for government regulations and policies that benefit the for-profit options and undermine the public program. These pro-corporate practices are already being embraced by the Trump administration to benefit the Advantage programs in their competition with traditional Medicare. The unchecked corporate ability to game the U.S. regulatory system is a key difference between any U.S. public option or ACA expansion proposal and the systems in other nations that retain a role for private insurance corporations. Nations such as Germany do accommodate private insurance, but only in a carefully circumscribed role and with substantial involvement by non-profit companies, an approach that bears little resemblance to any of the current U.S. proposals.

Seize the Opportunity for Meaningful Reform

Most fundamentally, keeping or even expanding the current practice of using taxpayer dollars to subsidize the profiteering of private corporations translates to a lost opportunity. Proposals that bypass Medicare for All to protect corporate CEO’s and shareholders deny the rest of us the benefit of massive savings, well-represented by the shocking disparity between Medicare’s overhead costs of around 2% and private corporations’ estimated overhead of 20%. As multiple economic analyses have demonstrated, we can use the savings from plugging up the pipeline hole diverting healthcare dollars to for-profit waste to fund our expansion into universal coverage.

A final problem with preserving an option for for-profit insurance plans is that the universality of the Medicare for All system is critical to its survival as a new institution in the U.S. The well-settled political reality in the U.S. and beyond is that universal benefit programs survive and even thrive, while limited-eligibility programs are at perpetual risk of reduction or even elimination. Social Security, Medicare, and public education have become the “third rail” of U.S. politics—elected officials touch them at their peril. Compare that to means-tested programs like Supplemental Nutrition Assistance Program (SNAP, aka Food Stamps), the Temporary Assistance for Needy Families program, and Head Start. All produce remarkable benefits yet have been on the budgetary chopping block for decades. Medicare for All will avoid that fate, and derive its political strength, from its final two words—“for All.”

Democratic Party leaders know all this. So, it’s time for them to overcome their fear of a powerful industry. It is time for them to listen to Americans who are demanding a substantial and sustainable change. And it is time for them to seize the moment, plug the profiteering hole in our system, and finally make healthcare a realized human right in our country.

Faith and Healthcare Notes

Action Opportunities for Lower Insulin Prices. Faith in Healthcare partner T1International is hosting on September 14th a vigil for those lost to the high price of insulin. The main vigil, where representatives of multiple families who recently lost loved ones to price-gouging will speak, will occur outside the Indianapolis headquarters of insulin manufacturer Eli Lilly and Company. Sister vigils will take place at multiple other locations across the country. For more information, check here. And look to our September 12th issue of Faith in Healthcare for a profile of one faith-motivated leader who is helping organize the vigil, and transforming her own struggles with Type 1 diabetes and insulin access into high-profile advocacy.

Going to Court Over Hospital Bills So Routine It’s Referred to as the "Follow-Up Appointment." From the Washington Post: “In the courtroom were some of Poplar Bluff Regional’s patients — a population that was on average sicker, older, poorer and underinsured compared with the rest of the United States . . Most of the 19 people on the morning docket had been treated in the emergency room . . . Many of them had insurance but still owed their co-pay or deductibles, which have tripled on average in the past decade across the United States. One patient owed more than $12,000 after being treated for a heart attack . . . If the hospital won a judgment, it had the right to garnish money from a patient’s paycheck or bank account or it could put a lien against a house.”

Continued Struggles to Access Mental Health Care. As a follow-up to concerns voiced here in Faith in Healthcare by American Muslim Health Professional’s Dr. Rukhsana Chaudhry and NAMI’s Doug Beach, a compelling article in Bloomberg Businessweek explores the same problem in “The State with the Highest Suicide Rate Desperately Needs Shrinks.”